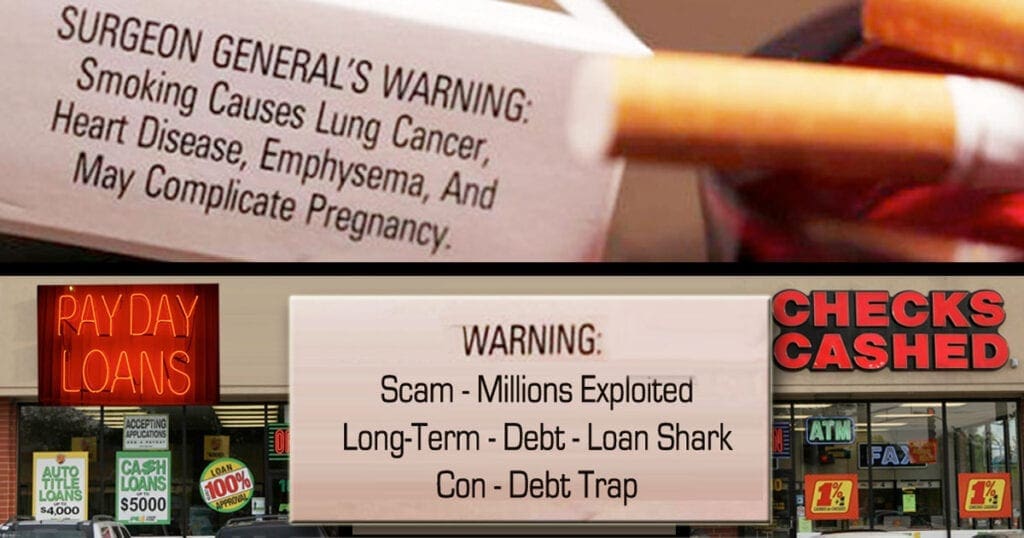

Should loans carry warnings?

The Society of St Vincent de Paul (SVP) has called for all licensed moneylenders to carry a tobacco-style warning on their advertising and literature.

When I saw the post from the Society of St. Vincent de Paul in Ireland I had two reactions.

My first reaction was “What an interesting approach to the issues of “pay day” or other loans that take advantage of unsuspecting people.”

My second reaction was “What a wonderful example of raising consciousness of such loans and lobbying to change the system.”

Some brief background

The SVDP petitioned the Department of Finance seeking the warning as well as the provision of alternatives for customers on the advertisements.

It says that “Warning: This is a high-cost loan” should feature on the ads, as well as advice for people to check their options before borrowing.

SVP estimates that there are 330,000 customers of moneylenders in Ireland.

In its submission, it said it was “astonishing” that no such warnings on ads for moneylenders.

According to the Central Bank, while moneylenders are required to provide information about the high-cost nature of the loan to their customers, this is typically provided in the moneylending agreement which must be signed by the customer, and is not a requirement for advertising the loans.

Other practical steps in advocating for change

Speak up!

Kieran Stafford, SVP National President said:

“SVP members regularly report inappropriate lending to very vulnerable households who do not have the capacity to repay the loan.

Educate yourself… and others.

The Pew Foundation Charitable Trusts research has found that when states do not implement standards around pricing and affordability, payday and auto title loans cost three to four times more than is necessary to have widespread access to this credit.

The Pew Foundation has made extensive studies of state “pay day” loan reforms.

Pew offers recommendations for making small loans safer and more affordable, and regularly provides analysis and technical assistance to state policymakers.

The problem is much worse for people without access to banks.

What can you and I do?

- Alert others to such problems and initiatives.

- Look for opportunities to partner with others who are attempting to change the system.

- Keep in mind that the problem is even worse for those without access to banks.

0 Comments